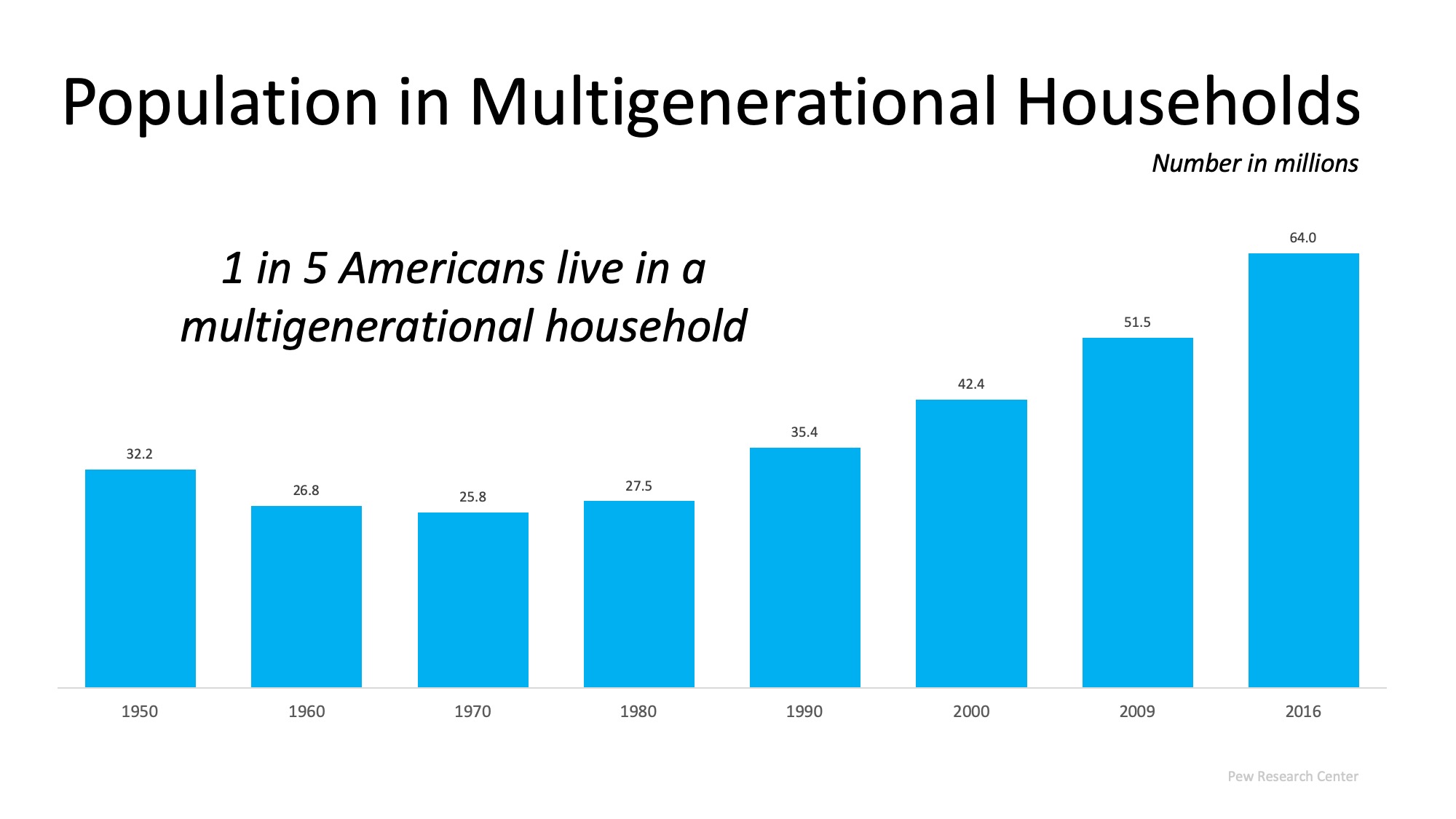

Did you know that 1 in 6 Americans currently live in a multigenerational household?

According to Generations United, the number of multigenerational households rose from 42.4 million in 2000 to 64 million in 2016. The 2018 Profile of Home Buyers and Sellers from the National Association of Realtors shows that 12% of all buyers have a multigenerational household.

Why Are Many Americans Choosing to Live in a Multigenerational Household?

The benefits to multigenerational living are significant. According to Toll Brothers,

“In recent years, there’s been a steady rise in the number of multigenerational homes in America. Homeowners and their families are discovering new ways to get the most out of home with choices that fit the many facets of their lives.”

The piece continues to explain the top 5 benefits of multigenerational living. Here is the list, and a small excerpt from their article:

1. Shared Expenses

“…Maintaining two households is undeniably costlier and more rigorous than sharing the responsibilities of one. By bringing family members and resources together under one roof, families can collectively address their expenses and allocate finances accordingly.”

2. Shared Responsibilities

“Distributing chores and age-appropriate responsibilities amongst family members is a tremendous way of ensuring that everyone does their part. For younger, more able-bodied members, physical work such as mowing the lawn or moving furniture is a nice trade-off so that the older generation can focus on less physically demanding tasks.”

3. Strengthened Family Bond

“While most families come together on special occasions, multigenerational families have the luxury of seeing each other every day. By living under one roof, these families develop a high level of attachment and closeness.”

4. Ensured Family Safety

“With multiple generations under one roof, a home is rarely ever left unoccupied for long, and living with other family members increases the chances that someone is present to assist elderly family members should they have an accident.”

5. Privacy

“One of the primary trepidations families face when shifting their lifestyle is the fear of losing privacy. With so many heads under one roof, it can feel like there’s no place to turn for solitude. Yet, these floor plans are designed to ensure that every family member can have quiet time… [and] allow for complete separation between the generations within the household.”

Bottom Line

The trend of multigenerational living is growing, and the benefits to families who choose this option are significant. If you’re considering a multigenerational home, let’s get together to discuss the options available in our area.

![Americans Rank Real Estate Best Investment for 6 Years Running! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/06/04095723/20190628-Share-KCM-1-571x300.jpg)

![Americans Rank Real Estate Best Investment for 6 Years Running! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/06/04095514/20190628-MEM.jpg)