As we approach the end of the year, many homeowners find themselves asking the question, “If we’re currently in a strong real estate market, why won’t my house sell?”

Below are the 5 most common reasons why a listing contract will expire:

1. The Price

Sometimes when the market is hot, homeowners attempt to set their listing price higher. Their hope is that a motivated buyer will be willing to pay any price for a house in their desired neighborhood! Sellers must remember, though, that in today’s market a house must be sold twice; first to the buyer and then to their bank.

A buyer can agree to pay the homeowner’s asking price, but after the bank conducts their appraisal, the price might need to be adjusted. The bank will only give the buyer a mortgage for the value of determined in the appraisal.

Sellers must also keep in mind that today’s homebuyers are well-educated. Before they look to buy a house, they have already seen many houses online. They’ve done their research on the neighborhoods they are interested in, including information on the school districts in the area.

They will know if your house seems overpriced and will not waste their time considering it. This is why it’s so important to make sure that your home is priced right from day one on the market!

2. The Condition of the House

In many areas, builders are taking advantage of the lack of inventory of homes for sale by building new houses. These newly constructed homes create competition for existing homes in the market. For this reason, many homeowners are making renovations and updates to their homes to compete with the new construction in their marketplace.

Most agents recommend that homeowners declutter their houses before putting them on the market. Buyers want to be able to imagine themselves living in the home instead of focusing on the current homeowner’s decor.

It’s important to take care of the small problems like dripping faucets and torn screens, while also remembering to remove any posters hanging in your teenager’s bedroom. Making sure your home is in perfect condition will make buyers fall in love with it and will ultimately help you get the right price for your house!

3. Seller’s Motivation

Why did the seller put their house on the market in the first place? Is the seller’s motivation still the same as it was when they first listed?

If homeowners are really motivated to sell, they will make sure their houses are both priced right and in good condition. The seller’s motivation will push them to consider all offers and help them make the right decision for their family’s future.

4. Marketing Plan

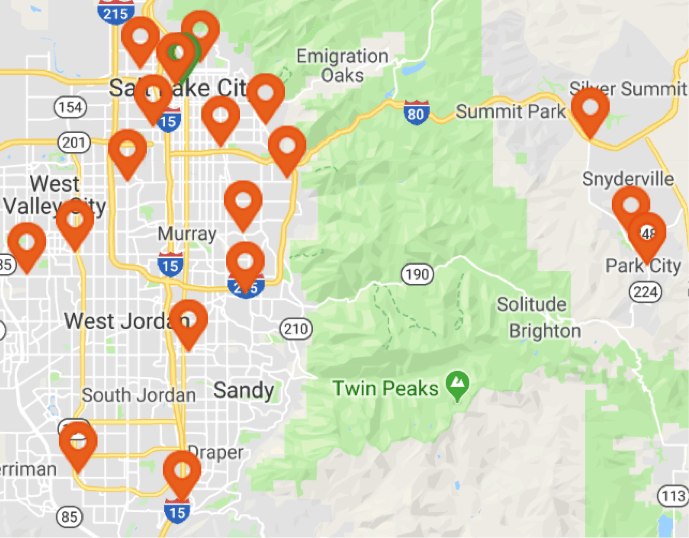

Having a marketing plan is important! According to NAR’s 2018 Profile of Home Buyers and Sellers, 95% of buyers searched online for a home last year. The days of looking for a newspaper ad or yard sign in your preferred neighborhood are over.

If you want to sell your home, you need a real estate professional who understands your local market and knows how to promote your home online. Something as simple as using pictures taken by a professional photographer can make a huge impact in advertising your home!

5. Lack of Communication with Your Agent

Keeping an open line of communication with your agent is crucial in getting your home sold with the least amount of hassles, in the right amount of time, and for the right price! From the beginning, establish a continuous line of communication with your agent, and make sure you review your agreement often to see if any changes need to be made. For example, adjusting the selling price!

Bottom Line

There are houses selling every single day because they are listed at the right price, they have the right marketing plan, and they are staged for the sale. If for some reason your home didn’t sell and you’re still motivated to get it sold, let’s get together to figure out the reason your house isn’t selling!

![Buyers Are Looking for Your Home, Now [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/12/20145101/20181221-Share-STM.jpg)

![Buyers Are Looking for Your Home, Now [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/12/20145053/20181221-STM-ENG.jpg)

![4 Reasons to Sell Your House This Winter [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/12/12114920/20181214-STM-ENG.jpg)