Success is something often worth repeating, and Brent Sutherland, a Certified Financial Planner and Real Estate Investor, has certainly made his way in a momentum-driving direction. Here are 3 tips he shares from a recent piece in Business Insider on the benefits of owning real estate:

1. Real estate diversifies your income

“While it is certainly important to be properly diversified with your investments, it is even more important to be diversified with your income. This is because the largest financial risk for most of you is the loss of your primary source of income, which is typically in the form of a day job.”

The article highlights how having multiple sources of income, such as those derived from real estate investments, can eventually lead to relying less and less on a day job. Sound dreamy? It can be. When done well, real estate investments may eventually open up your time and the financial freedom to explore other things, like travel and other aspirations you may have for the future, particularly in the golden years of retirement.

2. Real estate produces near-immediate results

“You can achieve and feel the results almost immediately. Property improvements are visible and tangible. You can cash, spend, and invest rent payments. Today! Not 30 years in the future.”

Currently, home prices are appreciating in all price ranges, and just last week CoreLogic announced their 12-month home value projection at 5.6%, an increase from 4.5% noted earlier this summer. With that in mind, real estate today is definitely driving immediate results!

3. Passive income can help you become financially independent sooner

“If you need $40,000 a year to live, you could alternatively invest in assets that generate an 8% cash-on-cash return. This is a very reasonable assumption. And it means you would only need to save a total of $500,000 (instead of $1 million). Yet, your investments would still meet your annual household living needs.

While returns, taxes, and inflation can, of course, affect your timeline, cash-flowing real-estate is a clear asset.”

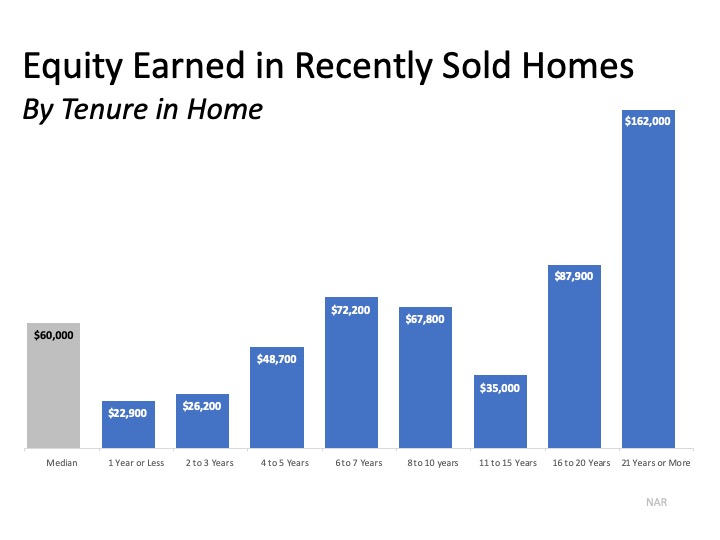

Homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth by increasing the equity in your home, bringing you one step closer to true financial independence.

Bottom Line

If you want to increase your savings and overall net worth, real estate is a great way to go. To learn how you can make it happen, let’s get together to discuss the process.

Who is Brent Sutherland?

Sutherland was 35 when he bought his first single home to rent out for income, less than five years later, he owns eight additional properties and part of a commercial real estate project.

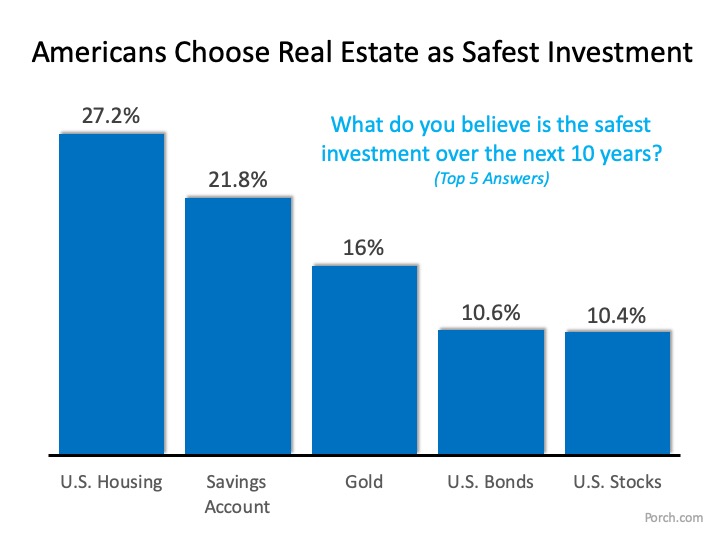

The findings of the Porch.com survey also coincide with two previous surveys done earlier this year:

The findings of the Porch.com survey also coincide with two previous surveys done earlier this year:

![Buyers Are Looking For Your Home [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/11/25101051/20191129-KCM-Share-549x300.jpg)

![Buyers Are Looking For Your Home [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/11/25101024/20191129-MEM-ENG-scaled.jpg)

![The Cost Across Time [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/11/20141141/20191122-Share-KCM-549x300.jpg)

![The Cost Across Time [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/11/21105716/20191122-MEM.jpg)